How does auto insurance for leased cars work?

Unlocking the Secrets: Demystifying Auto Insurance for Leased Cars

How does auto insurance for leased cars work? Understanding the ins and outs of insurance coverage for your leased vehicle can save you money and give you peace of mind.

Unlocking the Secrets: Demystifying Auto Insurance for Leased Cars

As an expert in the field of auto insurance, I’m here to unravel the complexities of how auto insurance for leased cars works. Leasing a car can be a smart financial move, but understanding the insurance that goes along with it is crucial. So, let’s dive into this often mystifying subject and shed light on the key aspects you need to know.

How does auto insurance for leased cars work?

Leasing a car is a popular option for many people who want to enjoy the benefits of a new vehicle without the long-term commitment of ownership. When you lease a car, the leasing company still owns the vehicle, and you’re essentially borrowing it for a fixed period. Since you don’t own the car, the leasing company typically requires you to have a specific type of auto insurance: full coverage insurance.

Full coverage insurance includes two main components: liability insurance and physical damage coverage. Liability insurance covers any bodily injury or property damage you may cause to others in an accident. This is a legal requirement in most states. Physical damage coverage, on the other hand, includes two subcomponents: collision and comprehensive coverage. Collision coverage pays for damages to your leased vehicle in the event of an accident, while comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters.

Understanding leased car insurance

Now, let’s dig deeper into the components of auto insurance for leased cars:

Liability Insurance

Liability insurance is the foundation of your auto insurance policy, whether you lease a car or own one. It protects you if you’re at fault in an accident and covers the other party’s medical expenses and property damage. Leasing companies usually require higher liability limits than the state minimums to protect their assets and the leased vehicle.

Collision Coverage

Collision coverage ensures that any damage to your leased car in an accident, regardless of fault, is covered. This is crucial for leased vehicles because any damage not repaired properly can affect the car’s value at the end of the lease term.

Comprehensive Coverage

Comprehensive coverage is your safety net against non-accident-related damage. If your leased car is stolen, vandalized, or damaged by hail, comprehensive coverage steps in to cover the costs.

Insurance Terms for Leases

To navigate the world of auto insurance for leased cars effectively, you need to be familiar with some key terms:

Gap Insurance: Gap insurance is a must for leased cars. It covers the “gap” between what you owe on your lease and the actual cash value of the car in the event of a total loss. This ensures you’re not stuck with a hefty bill if your leased car is declared a total loss.

Residual Value: The residual value is what the leasing company estimates the car will be worth at the end of your lease. This value can affect your insurance rates.

Lease Agreement Insurance Requirements: Your lease agreement will specify the exact insurance requirements, so it’s essential to read it carefully and make sure your policy complies.

Leased Car Protection

Leased car protection is a collaborative effort between you and your insurance company. To protect your investment, follow these guidelines:

Maintain your leased car according to the manufacturer’s recommendations to prevent wear and tear.

Keep up with your monthly insurance payments to avoid coverage gaps.

Review your lease agreement regularly to ensure compliance with insurance requirements.

When the lease ends, return the car in good condition to avoid additional charges.

The Auto Insurance Jargon

Auto insurance, in general, can be filled with jargon and complex terminology. Here are some common terms you might encounter:

Deductible: The amount you pay out of pocket before your insurance kicks in.

Premium: The cost of your insurance, usually paid monthly.

Underwriting: The process insurance companies use to determine your risk and set your rates.

Claim: A request to your insurance company to cover a loss.

Car Leasing Insurance Guide

To sum it up, understanding how auto insurance for leased cars works is vital for a worry-free leasing experience. It’s all about ensuring that your investment – the leased vehicle – is protected against any unforeseen circumstances. So, whether you’re new to leasing or a seasoned pro, knowing the ins and outs of auto insurance for leased cars is a valuable asset.

In conclusion, having the right insurance coverage is key to a smooth and stress-free leasing experience. By unlocking the secrets and demystifying auto insurance for leased cars, you can make informed decisions, protect your investment, and drive your leased vehicle with confidence.

Don’t hesitate to ask questions or share your thoughts in the comments below. We’d love to hear about your experiences with auto insurance for leased cars and any additional tips or insights you might have. Join the conversation and let’s make auto insurance for leased cars less mysterious and more manageable.

And if you’re ready to explore more expert insights, product reviews, and lifestyle tips, remember that TellGrade is your go-to brand for all things informative and engaging. Stay tuned for more updates, and be sure to subscribe to our newsletter to never miss out on the latest news and insights.

Unlocking the Secrets: Demystifying Auto Insurance for Leased Cars

Understanding how auto insurance for leased cars works is the first step to making informed decisions and securing your investment. In this comprehensive guide, we’ve revealed the intricacies of leased car insurance, shedding light on a subject that often appears complex and perplexing.

Now, armed with this newfound knowledge, it’s time to take action. Leased car insurance is not merely an expense; it’s a safeguard for your financial well-being. As you embark on the journey to unravel the secrets, consider the next steps. By choosing the right insurance coverage, you can protect yourself, your leased vehicle, and your peace of mind.

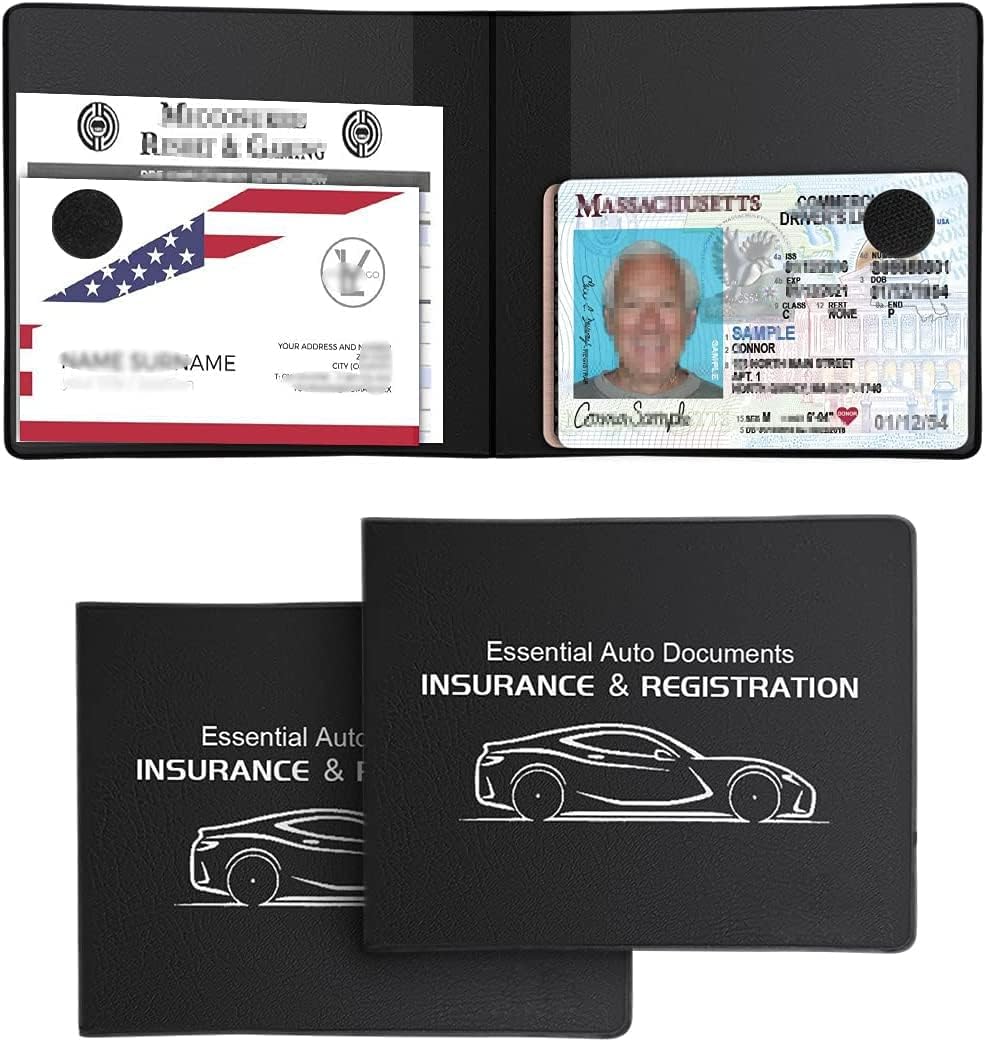

To simplify your search for the ideal insurance coverage, we’ve curated a selection of affiliate products related to leased car insurance. These products have been carefully chosen to align with the insights and information you’ve just gained. Whether you’re seeking comprehensive coverage, gap insurance, or solutions to reduce your premium costs, our recommended products are here to assist you in making the right decisions. So, let’s move from understanding to action – explore the offerings and secure the insurance that best suits your needs.

Shop Products On Amazon

Shop Products on Ebay

Trending Similar Stories in the News

Best Car Insurance for High-Risk Drivers of 2023 — U.S. News & World Report

October 23, 2023 — U.S. News & World ReportBest Car Insurance for High-Risk Drivers of 2023 U.S. News & World Report…

New-car lemon law: fact sheet — New York State Attorney General

October 17, 2023 — New York State Attorney GeneralNew-car lemon law: fact sheet New York State Attorney General…

Trending Videos of How does auto insurance for leased cars work?

Similar Popular Articles

Related Posts

Mastering Leased Car Insurance: Your Key to Savings and Peace of Mind

#AutoInsurance #CarLeasing #InsuranceExplained #AutoTips #CarCoverage #LeasedVehicles #InsuranceDemystified #AutoAdvice #SaveonInsurance #InsuranceInsights

“auto insurance guide, car leasing insurance, understanding lease insurance, demystifying car insurance, leased vehicle coverage, insurance for leased cars, insurance terms for leases, save on car insurance

![Unravel The Secrets: Demystifying Auto Insurance For Leased Cars 7 Essential car auto insurance registration black document wallet holders 2 pack - [bundle, 2pcs] - automobile, motorcycle, truck, trailer vinyl...](https://m.media-amazon.com/images/I/61tGnylmIFL._AC_SL520_.jpg)