What’s the difference between whole life and term life insurance?

Unlocking the Secrets: Whole Life vs. Term Life Insurance — Which One’s Right for You?

What’s the difference between whole life and term life insurance? Let’s explore the key contrasts to help you make the right choice for your financial future.

Unlocking the Secrets: Whole Life vs. Term Life Insurance — Which One’s Right for You?

If you’re like most people, insurance is something you’ve probably thought about at some point in your life. It’s a crucial component of financial planning, providing a safety net for you and your loved ones. Two common types of life insurance are whole life and term life insurance. But what’s the difference between these two options, and how do you choose the right one for your specific needs? In this comprehensive guide, we’ll delve into the nitty-gritty details of whole life and term life insurance, helping you make an informed decision about which one aligns with your financial goals.

Understanding the Basics

Whole Life Insurance Benefits

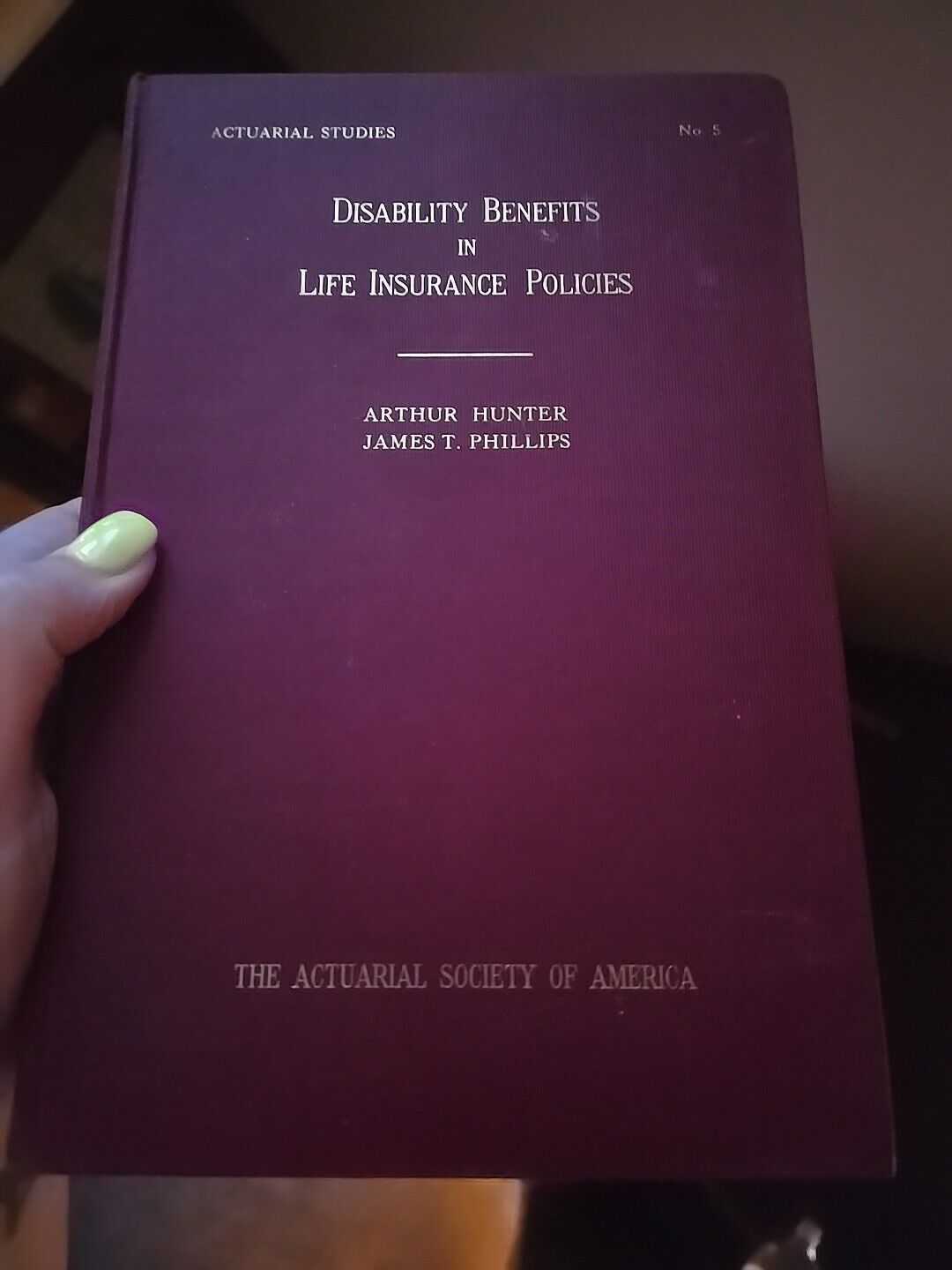

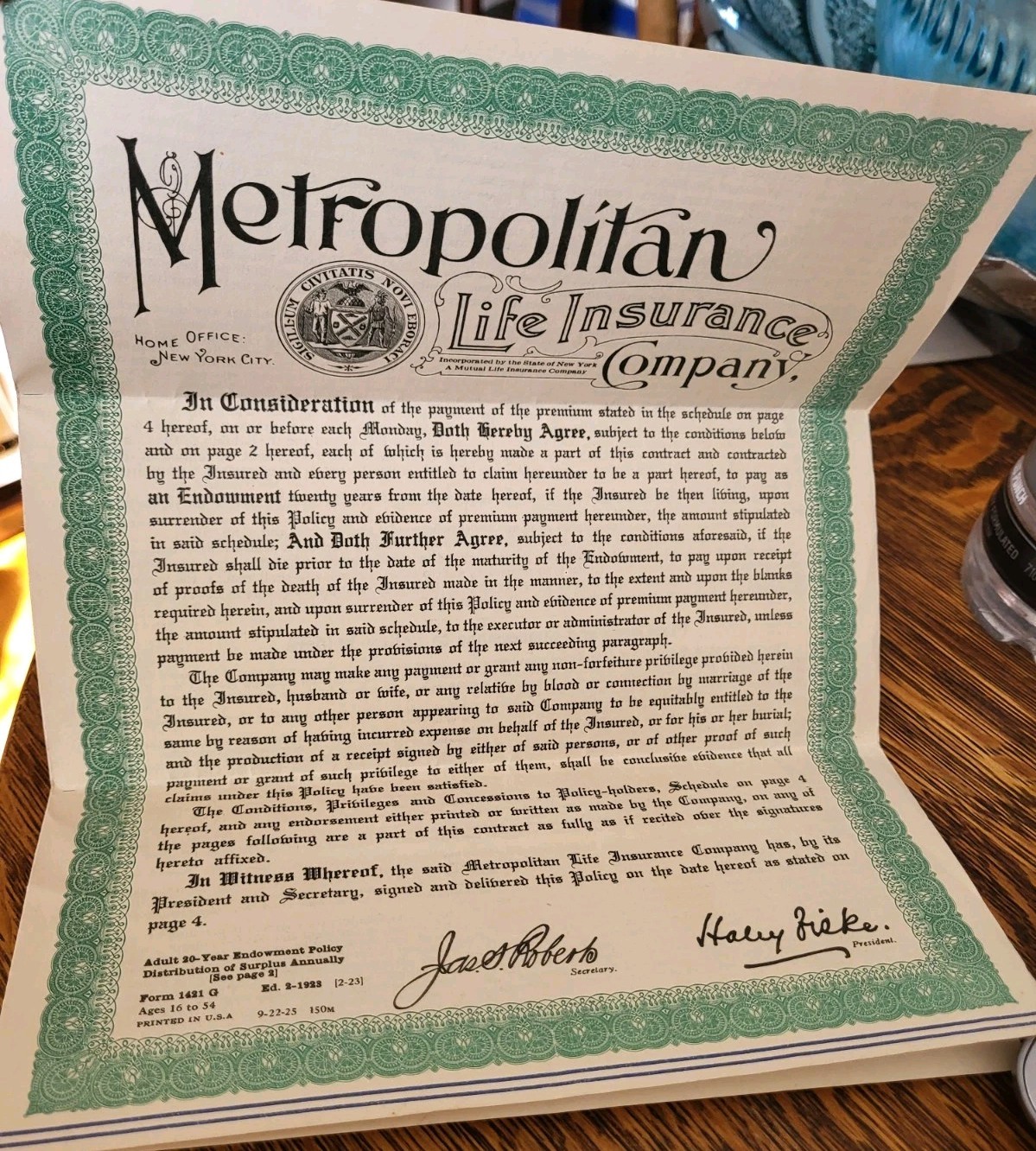

Whole life insurance is often seen as a long-term investment. It offers a death benefit, which means your beneficiaries will receive a payout when you pass away. However, it comes with the added perk of accumulating cash value over time. This means that as you pay your premiums, a portion of that money is set aside and invested, growing over the years. Whole life insurance provides lifelong coverage, and some policies may even pay dividends.

Term Life Insurance Features

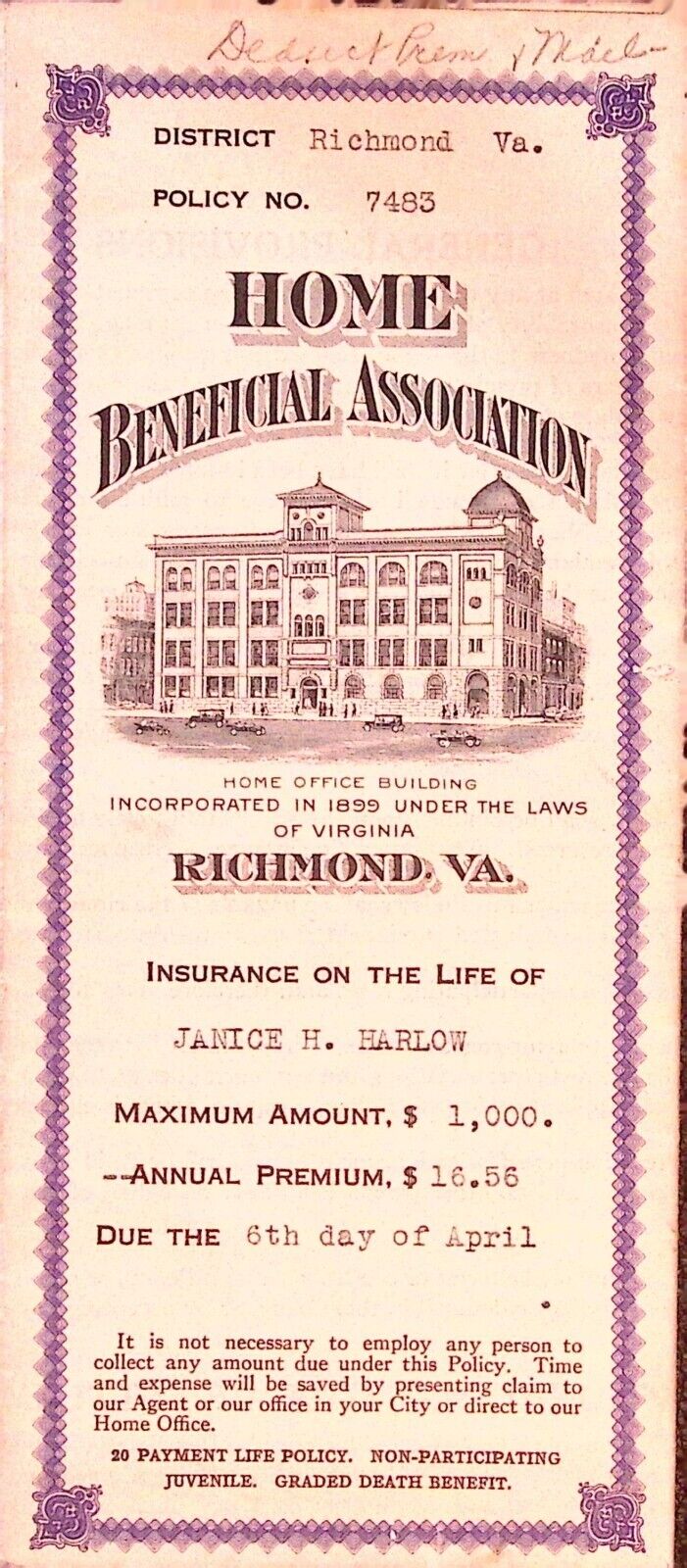

In contrast, term life insurance is more straightforward. It provides coverage for a specified term, usually 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive the death benefit. However, term life insurance does not build cash value, and it’s generally more affordable than whole life insurance.

Comparing Whole Life and Term Life Insurance

Now, let’s break down the differences between these two insurance options.

Permanent Life Insurance vs. Term Life

One of the most significant distinctions is the permanence of whole life insurance. It’s designed to last your entire lifetime, providing peace of mind for your loved ones. Term life insurance, on the other hand, only covers you for a specific period.

Whole Life Insurance Cash Value

As mentioned earlier, whole life insurance policies have a cash value component. This cash value can be borrowed against or withdrawn, providing a financial cushion for various needs.

Term Life Insurance Premiums

Term life insurance is known for its affordability. The premiums are typically lower compared to whole life insurance. This makes it an attractive option for individuals looking for temporary coverage.

Choosing the Right Life Insurance

Selecting the right life insurance depends on your individual circumstances. Consider factors such as your age, financial goals, and the needs of your dependents. If you’re looking for a long-term investment and a death benefit, whole life insurance may be the way to go. On the other hand, if you need coverage for a specific period and want to keep your premiums low, term life insurance could be the better choice.

Whole Life Insurance Explained

To dive deeper into whole life insurance, it’s essential to understand the nuances. Whole life policies come in various forms, including traditional whole life, universal life, and variable life. Each has its own set of features and benefits. Traditional whole life insurance provides fixed premiums and a guaranteed cash value growth. Universal life insurance offers more flexibility in premium payments and death benefits. Variable life insurance allows you to invest your cash value in various accounts.

Term Life Policy Details

When considering term life insurance, you’ll want to examine the specifics of the policy. The term length is a critical factor. Choose a term that aligns with your financial goals. Additionally, some term life policies offer the option to convert to whole life insurance later on, providing flexibility for your changing needs.

Life Insurance Comparison Guide

To help you make an informed decision, it’s advisable to create a life insurance comparison guide. List out the pros and cons of each type of insurance based on your unique situation. Consider factors like your age, health, financial obligations, and future plans. This guide will serve as a valuable tool in making the right choice.

Whole Life or Term Insurance? Making the Right Insurance Choice

The age-old question of whole life or term insurance is one that many individuals grapple with. It’s not a one-size-fits-all answer. Instead, it’s about finding the perfect fit for your current and future financial needs. Both options have their advantages and drawbacks, so a thorough evaluation of your circumstances is essential.

Incorporating New Perspectives

While the basics of whole life and term life insurance are important, it’s also crucial to consider new perspectives and emerging trends in the insurance industry. For instance, the concept of “hybrid” insurance policies, which combine elements of both whole life and term life, is gaining traction. These policies offer the security of a death benefit with the potential for cash value growth. Exploring innovative insurance products can be a game-changer for your financial planning.

Making the Informed Choice

In conclusion, the difference between whole life and term life insurance is significant, and understanding these distinctions is vital to making an informed choice. It’s essential to align your insurance choice with your current financial situation, future goals, and the needs of your loved ones. Whether you opt for the lifelong coverage of whole life insurance or the affordability of term life insurance, your decision should reflect your unique circumstances.

By choosing the right life insurance, you’re not just providing financial security; you’re also making a long-term investment in your family’s future. So, consider your options carefully, weigh the benefits, and make the choice that best suits your individual needs.

Don’t forget to share your thoughts and experiences with us in the comments section below. We’d love to hear about your journey in selecting the right insurance and any questions you might have. Join the conversation and be a part of our growing community.

And if you found this guide helpful, be sure to subscribe to our newsletter for more informative articles, reviews, and expert insights. TellGrade is your go-to source for all things related to lifestyle, finance, and more. Stay tuned for the latest updates and valuable tips to enhance your life.

Let’s make informed choices and secure our future together! 💼💡👨👩👧👦

As you’ve delved into the intricate world of whole life versus term life insurance, it’s clear you’re committed to making the best choices for your financial security and your loved ones’ future. Now, let’s take this journey one step further by exploring some valuable life insurance policies that can perfectly align with your needs.

Life insurance policies come in various forms, each tailored to different life situations. Whether you’re looking for lifelong protection and a financial cushion for your family or simply need coverage for a specified term, there’s an option for you. By carefully considering the merits of whole life and term life insurance, you’ve already set a strong foundation for making an informed choice.

Now, let’s explore the practical side. Below, you’ll find a selection of life insurance policies that offer diverse features and benefits. These options have been curated to cater to various preferences, and you’ll discover how they can provide the financial security and peace of mind you’re seeking. Take a moment to review these offerings, and when you’re ready to make that important decision, simply click through to learn more and find the policy that’s the perfect fit for you.

Shop Products On Amazon

Shop Products on Ebay

Trending Similar Stories in the News

Do You Have a Life Settlement Case? — ThinkAdvisor

October 23, 2023 — ThinkAdvisorDo You Have a Life Settlement Case? ThinkAdvisor…

The best life insurance policies for children can guarantee insurability later in life — CNBC

October 18, 2023 — CNBCThe best life insurance policies for children can guarantee insurability later in life CNBC…

Trending Videos of What’s the difference between whole life and term life insurance?

Similar Popular Articles

Related Posts

The Ultimate Guide to Mastering Whole Life vs. Term Life Insurance

#LifeInsurance, #TermLife, #WholeLife, #InsuranceComparison, #FinancialPlanning, #InsuranceGuide, #FamilySecurity, #Investment, #MoneyMatters, #InsuranceExplained, #ChooseWisely, #SecureYourFuture, #FinancialWellness, #InsuranceOptions, #ProtectYourLovedOnes

Whole life insurance comparison, Term life insurance features, Choosing the right life insurance, Life insurance benefits, Term life vs whole life, Permanent life insurance analysis, Whole life insurance cash value, Selecting the perfect policy, Life insurance decision guide, Understanding life insurance options